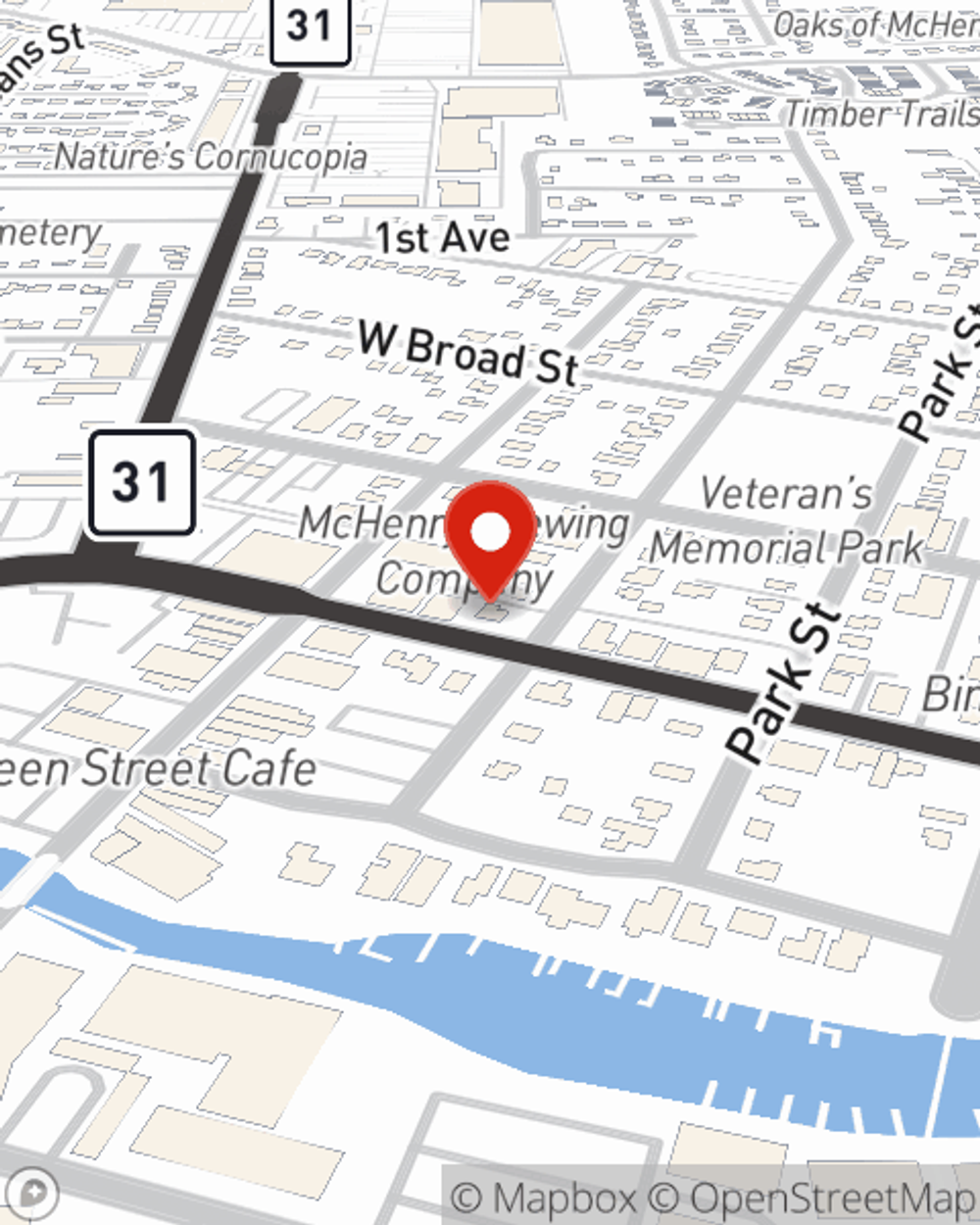

Business Insurance in and around McHenry

Researching protection for your business? Look no further than State Farm agent John Sutton!

Helping insure small businesses since 1935

Help Protect Your Business With State Farm.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected loss or accident. And you also want to care for any staff and customers who hurt themselves on your property.

Researching protection for your business? Look no further than State Farm agent John Sutton!

Helping insure small businesses since 1935

Protect Your Future With State Farm

With options like a surety or fidelity bond, worker's compensation for your employees, business continuity plans, and more, having quality insurance can help you and your small business be prepared. State Farm agent John Sutton is here to help you personalize your policy and can assist you in submitting a claim when the unexpected does occur.

Don’t let worries about your business stress you out! Visit State Farm agent John Sutton today, and find out how you can save with State Farm small business insurance.

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

John Sutton

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.